Featured

Table of Contents

Image Are registered in the California Alternative Prices for Energy (TREATMENT) or Family Members Electric Price Assistance (FERA) program. Have made at the very least one on-time settlement in the past 24 months.

Consumers who register in the AMP program are not eligible for installation plans. Web Power Metering (NEM), Direct Accessibility (DA), and master metered customers are not presently eligible. For clients intending on moving within the next 60 days, please use to AMP after you've developed solution at your brand-new move-in address.

The catch is that nonprofit Credit Card Financial obligation Forgiveness isn't for everyone. InCharge Financial obligation Solutions is one of them.

"The various other emphasize was the mindset of the counselor that we might obtain this done. I was feeling like it wasn't mosting likely to take place, however she maintained with me, and we got it done." The Credit Rating Card Forgiveness Program is for people who are until now behind on bank card settlements that they remain in significant financial trouble, perhaps encountering insolvency, and don't have the income to catch up."The program is specifically made to aid clients whose accounts have been charged off," Mostafa Imakhchachen, customer treatment professional at InCharge Financial debt Solutions, said.

Getting My What to Watch For While Evaluating a Debt Counseling Provider To Work

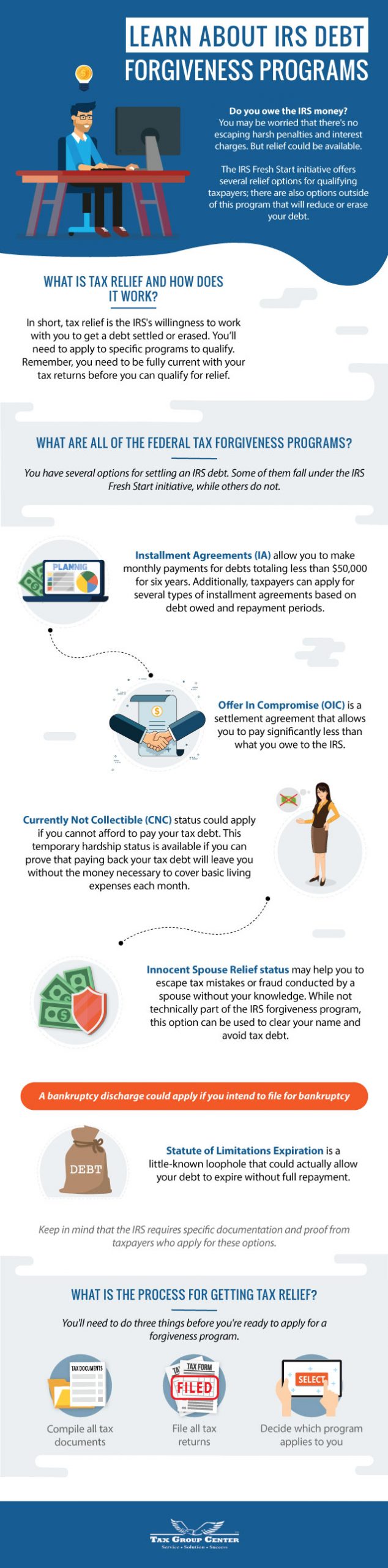

Financial institutions that participate have concurred with the not-for-profit debt counseling company to accept 50%-60% of what is owed in dealt with monthly settlements over 36 months. The fixed settlements mean you recognize exactly how much you'll pay over the payment period. No interest is billed on the balances during the payoff duration, so the repayments and amount owed don't alter.

It does show you're taking an energetic duty in lowering your financial obligation. Because your account was currently way behind and charged off, your credit report was currently taking a hit. After negotiation, the account will certainly be reported as paid with an absolutely no equilibrium, instead of exceptional with a collections company.

The agency will certainly pull a debt record to understand what you owe and the level of your challenge. If the forgiveness program is the best solution, the therapist will certainly send you an arrangement that details the plan, including the amount of the regular monthly settlement.

When everybody agrees, you start making regular monthly payments on a 36-month plan. When it mores than, the agreed-to amount is eliminated. There's no penalty for settling the equilibrium early, however no expansions are permitted. If you miss out on a settlement, the arrangement is nullified, and you have to leave the program. If you believe it's a good alternative for you, call a counselor at a not-for-profit credit history counseling agency like InCharge Financial debt Solutions, who can answer your inquiries and assist you identify if you qualify.

A Biased View of APFSC Approach to Reach Debt Freedom

Due to the fact that the program allows debtors to opt for much less than what they owe, the creditors who get involved want peace of mind that those that take benefit of it would not be able to pay the sum total. Your charge card accounts also have to be from banks and debt card business that have consented to participate.

If you miss out on a settlement that's just one missed repayment the agreement is ended. Your financial institution(s) will terminate the plan and your balance goes back to the original amount, minus what you have actually paid while in the program.

With the forgiveness program, the financial institution can rather choose to maintain your financial obligation on guides and recoup 50%-60% of what they are owed. Nonprofit Charge Card Financial debt Forgiveness and for-profit debt settlement are comparable in that they both offer a means to settle bank card debt by paying less than what is owed.

Not known Facts About Recovering Your Financial Standing the Strategic Way

Charge card forgiveness is made to set you back the customer less, pay off the debt quicker, and have fewer disadvantages than its for-profit equivalent. Some vital areas of difference in between Bank card Debt Forgiveness and for-profit financial obligation settlement are: Bank card Debt Mercy programs have partnerships with financial institutions that have agreed to take part.

Once they do, the payback duration begins immediately. For-profit financial obligation negotiation programs discuss with each creditor, typically over a 2-3-year duration, while interest, fees and calls from debt collection agencies continue. This implies a larger hit on your debt report and credit history, and a raising equilibrium till settlement is completed.

Credit Rating Card Financial obligation Forgiveness clients make 36 equal monthly payments to eliminate their debt. For-profit debt negotiation clients pay into an escrow account over a settlement period toward a swelling sum that will certainly be paid to lenders.

Table of Contents

Latest Posts

Some Known Incorrect Statements About How Top Providers Differ from the Industry

Unknown Facts About Comparing Debt Relief Companies to Select the Right Partner

Indicators on The Value of Accredited Bankruptcy Counselors You Should Know

More

Latest Posts

Some Known Incorrect Statements About How Top Providers Differ from the Industry

Unknown Facts About Comparing Debt Relief Companies to Select the Right Partner

Indicators on The Value of Accredited Bankruptcy Counselors You Should Know